Third Stage Of Money Laundering Process

The idea of money laundering is very important to be understood for these working within the monetary sector. It's a process by which soiled money is converted into clean money. The sources of the cash in precise are felony and the money is invested in a means that makes it appear like clean cash and hide the id of the criminal part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new customers or sustaining present customers the obligation of adopting enough measures lie on every one who is part of the group. The identification of such aspect to start with is simple to take care of instead realizing and encountering such situations later on in the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such situations.

The third step of the traditional money laundering process involves integration andor extraction. Integration is the third stage of money laundering.

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

The dirty money is now absorbed into the economy for instance via real estate.

Third stage of money laundering process. Investing in real estate. The money laundering cycle can be broken down into three distinct stages. In terms of money laundering integration marks the transition from dealing exclusively in illicit funds to a state in which dirty money and.

The stages of money laundering include the. Third Stage of Money Laundering- Integration The Third Stage of Money Laundering ie Integration is the final stage in the process and in this stage the Cleaned Money is back into the economy. KYC Know Your Customer KYC is the process of verifying the identity of your customers to understand their suitability for your business and to know the risks for the company in maintaining the relationship with them.

However it is important to remember that money laundering is a single process. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards.

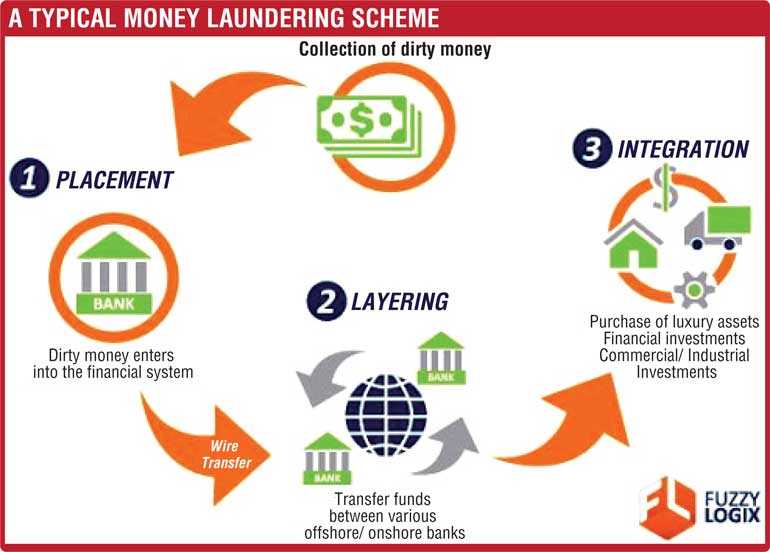

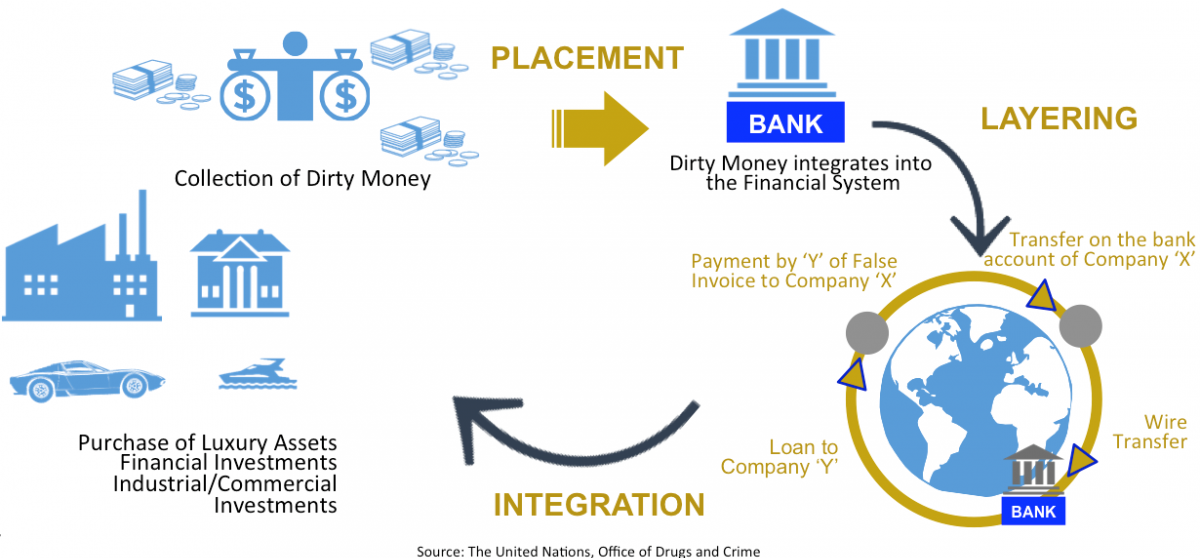

Placement This is the movement of cash from its source. It is the third stage of the money laundering process in which the money moves in the system as clean money. While money laundering is a single process it does have three stages.

Investing in other legitimate business interests. There are three stages involved in money laundering. There are several ways of putting the Cleaned Money into the Economy but the most common way is to invest in properties.

The third stage in the money laundering process is integration. Placement layering and integration. Once the dirty money has been placed and layered the funds will be integrated back into the legitimate financial system as legal tender.

Placement the initial entry of funds into the financial system serves the purpose of relieving the holder of large amounts of actual cash and positioning these funds in the financial system for the next stage. Placement Stage Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. The ill-gotten gains may be sent to a legitimate enterprise in the economy or used by the criminal for his or her personal lifestyle.

Not all money-laundering transactions involve all three distinct phases and some may indeed involve more van Duyne 2003. The third stage of the money laundering process involves the placement of the laundered money back into the economy and financial system in such a way that it appears to be clean and legitimate and is available for use by criminals to buy expensive cars and property or invest in different stocks unit trusts and money market. Placement layering and integration stage.

Layering the next stage describes a series of transactions designed to conceal the moneys origin. Money laundering typically includes three stages. And at the same time hiding its source.

The third of the stages of money laundering is integration. 1The first stage involves the Placement of proceeds derived from illegal activities the movement of proceeds frequently currency from the scene of the crime to a place or into a form less suspicious and more convenient for the criminal. During the integration stage illegal pro-ceeds are converted into apparently legitimate business earnings through normal financial or commercial operations.

5-6 6 Money Laundering Process Money Laundering consists of three stages.

Three Stages Of Money Laundering Download Scientific Diagram

What Is Money Laundering Three Methods Or Stages In Money Laundering

The Third Stage In The Washing Cycle Integration Onestopbrokers Forex Law Accounting Market News

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Why Are Kyc And Cdd Required Daily Ft

Pin On Prodefence Security News

Understanding Money Laundering European Institute Of Management And Finance

The Stages Of Money Laundering Dimension Grc

Three Stages Of Money Laundering Download Scientific Diagram

What Is Money Laundering Three Methods Or Stages In Money Laundering

What Are The Three Stages Of Money Laundering

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

Understanding Money Laundering European Institute Of Management And Finance

The world of laws can look like a bowl of alphabet soup at instances. US money laundering rules aren't any exception. We now have compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency targeted on protecting monetary companies by decreasing danger, fraud and losses. We've large financial institution experience in operational and regulatory risk. We now have a powerful background in program administration, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many opposed consequences to the organization as a result of risks it presents. It will increase the probability of main risks and the opportunity value of the financial institution and finally causes the bank to face losses.